Table of Contents

ToggleAfter close to a decade as a debt recovery law firm, the Rule & Co team has seen many businesses give in to pressure as customer debts pile up and make decisions that prioritise recovery at the cost of reputation.

Without fail, they’ve regretted it, and our response was “You probably didn’t have to do that!”

The reality for most is that customer debt recovery is an ongoing challenge, and our guide arms new businesses with the two biggest things that help tackle it efficiently and avoid knee-jerk reactions:

- essentials on debt recovery laws in Malaysia, and

- a clear process to track payments and manage outstanding debts

Of course, readers are welcome to skip the guide and reach out for a free recovery assessment!

Laws on debt recovery in Malaysia

There are two key legal considerations for businesses, namely the limitation period to recover a debt and rate of interest, if any, to charge on unpaid invoices.

Limitation period to recover a debt

Malaysia’s Akta Had Masa 1953 is the law to know for creditors, as this Act establishes:

- creditors have a 6-year time limit from the date a debt becomes due to recover it

- creditors lose the legal right to claim the debt is this period expires

- the clock resets each time a debtor acknowledges the debt or makes partial payment

The above applies regardless of debt value, and we have experienced many debtors attempting to delay payment or ignore a creditor until the limitation period runs out.

The sooner a business acts, the better the chances of recovering a debt.

Rate of interest on unpaid invoices

A delinquent customer typically means overdue invoices, and businesses will want to charge interest on the outstanding amount.

In Malaysia, this requires two conditions to be legally enforceable:

- agreement from both parties in the contract or invoice

- the interest rate is not ‘excessive’ or ‘unconscionable’

The first is simple: Have a clause in your invoices and contracts that clearly states the overdue interest rate!

The second is more subjective, and while there’s no hard rule, 1.5% per month or 18% per year has become an unofficial standard generally accepted by Malaysian courts.

This doesn’t mean creditors cannot seek a higher rate, especially if explicitly stated and agreed to by the customer, but there is a risk of it being challenged as unfair.

Establishing debt recovery probability

Here’s a painful truth we sometimes have to tell our clients: Some debts are unrecoverable.

Here’s an even more painful truth: A debt can be technically recoverable, but with chances of success so low that pursuing it will likely cause the client even more losses.

Before investing resources, assess chances of recovery with three questions:

1. Does the debtor still exist?

Whether your customer is a private individual or business, if they are bankrupt or insolvent, recovery is unlikely without a personal guarantor.

For individual debtors, check e-Insolvensi.

If they are a business entity, check these sources:

- Sdn Bhds / Enterprises: MYDATA-SSM

- LLPs: SSM Reprint Services

2. Is the debt defendable?

Determine if the customer has a valid reason for non-payment.

If they have proof of a genuine dispute (e.g. dissatisfaction with services), expect negotiations or possible litigation, but if they refuse to pay without defense, recovery is more straightforward.

3. Does the debtor have the means to pay?

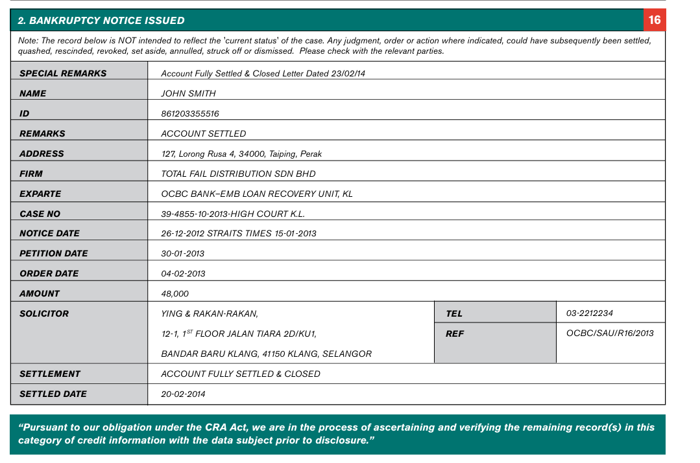

Review the debtor’s CTOS or SSM Company Profile for financial indicators such as paid-up capital and balance sheet health.

Bear in mind that CTOS reports are not perfect, so for larger debts, it may be worth engaging a private investigator or forensic consultant to uncover hidden assets or income sources.

With these three questions answered, a business can better choose between pursuing a debt or writing it off as a loss.

Steps in the debt recovery process

In a best-case scenario, a single payment reminder is enough to prompt full repayment or at least open the door to negotiations. However, we advise creditors to hope for the best, but prepare for the worst!

Here are all possible steps in a typical debt recovery process.

Step 1: Payment reminders

This is a polite but firm reminder with key details of the debt asking the debtor to settle the payment by a certain date.

Creditors can send as many as they want, but our recommendation is to send two:

- an initial overdue payment reminder, followed by

- a final payment reminder

Here’s an editable template of the first to start you off.

Overdue payment reminder template

Dear

We hope this message finds you well. Our records show that invoice , dated , for the amount of RM is still outstanding. As of today, the payment has been overdue by days.

As a gentle reminder, payments are due according to our agreed terms. To keep everything running smoothly, we would appreciate it if the outstanding balance of RM could be settled by .

Payment can be made to the following account:

- Bank Name:

- Account Name:

- Account Number:

If payment has already been made, please disregard this reminder. Otherwise, we kindly ask that you give this matter your earliest attention. Should you need to discuss anything, please feel free to reach us at .

Thank you very much for your cooperation and prompt response.

Best regards,

In our opinion, this is more than enough to determine that the customer does not intend to repay the debt, and a third reminder would make no difference.

Step 2: Letter of Demand (LOD)

This is a document issued by a lawyer to the debtor, giving a fixed deadline to make payment. It also warns that legal action will follow if payment is not made.

Note: Creditors can technically call their own reminders a Letter of Demand and threaten legal action, but it’s more of a bluff than anything–it is the lawyer’s LOD that carries legal weight.

Step 3: Full repayment or negotiation

The debtor responds, allowing both parties to enter into negotiations to discuss repayment plans or possible settlements.

Step 4: Litigation and enforcement

If negotiations fail, a creditor is confident can pursue legal action through different courts depending on the level of debt:

- Small Claims Court for debts RM5,000 and below

- Magistrates’ Court for debts up to RM100,000

- Sessions Court for debts between RM100,001 – RM1,000,000

- High Court for debts above RM1,000,000

Note that just because a creditor can take a debtor to court, doesn’t mean they should, but that said, a court judgement allows the debt to be recovered via multiple enforcement methods.

6. Tax deduction

If the debtor is unable to pay, the creditor can apply for a tax write-off, ensuring they don’t owe tax on the unpaid amount.

Mistakes that weaken debt recovery success rates

It’s common for newer businesses to fall victim to ‘professional debt avoiders’ who know exactly how to exploit an inexperienced creditor and the law.

Common mistakes include:

- giving indefinite payment extensions

- relying on spoken agreements for late payment interest rates

- avoiding escalation for fear of damaging relationships, and

- agreeing to terms that rely on indefinite conditions (ex: I’ll pay you when I have money)

The last one might as well be “I’ll pay you when I win the lottery!”

To new creditors, our advice is to put your business first—your debtor is almost certainly doing just that when they refuse to pay.

Pursuing debts through Malaysian courts

If negotiations have failed and the business believes the debt is recoverable, a court judgment opens the door to powerful enforcement methods that are otherwise unavailable.

| Method | Description |

| Writ of Seizure and Sale (WSS) | Allows court to seize and sell debtor’s assets to satisfy the debt |

| Garnishee proceedings | Recover money directly from third party that owes your debtor |

| Judgment Debtor Summons | Requires debtor to appear in court and disclose their financial situation |

| Bankruptcy | Seize and sell individual debtor’s assets |

| Forced winding up | Liquidate the corporate debtor’s assets |

However, in our professional opinion, unless the debt is substantial (> RM150,000) the effort and expense rarely has a favourable ROI for creditors once factoring in:

- costs of legal representation

- the fact cases can drag on for years

- enforcement is still required to recover payment after winning

- the small (but non-zero) chance of losing a case!

The exception is debts under RM5,000 handled through the Small Claims Court, as it has been designed to process smaller cases without the need for lawyers.

Engaging professional debt collection services

Businesses who don’t have time or simply don’t want to directly deal with it can outsource debt collection to agencies or law firms, both of whom provide recovery services but work differently:

| Factor | Agencies | Lawyers |

| Typical fee structure | Success-based (paid upon recovery) | Hourly with significant upfront fees |

| Regulation | No central regulating body | Licensed and regulated by the Malaysian Bar Council |

| Conduct | Varies from agency to agency | All bound by strict conduct rules |

| Recovery methods | Phone calls, emails, and negotiations | Letters of Demand, filing civil suits, and subsequent legal enforcement |

While Rule & Co is, of course, a debt recovery law firm and slightly biased, we believe a good lawyer helps strike a balance between debt recovery and staying compliant with the law.

Tax deductions for unrecoverable debts

In the worst-case situation, a customer simply cannot afford to repay a debt, and it’s time to cut your losses with a tax write off so the business doesn’t owe tax on the unpaid invoice(s).

Claiming this is a straightforward two-step process:

- Issue a Letter of Demand (LOD): This serves as proof of the unpaid debt

- Obtain supporting statements: Lawyers or auditors may need to provide verification, particularly for larger sums

It is a bitter pill to swallow, but it beats owing tax on an unpaid debt!

A 4-step debt recovery workflow

Here’s a simple process any business can follow, and at the very least, implement the first step!

1. Use invoicing software

An invoicing software that complies with Malaysian tax laws is the first line of defense against unpaid debts, as it can automatically:

- generate SST-compliant invoices

- set clear payment terms and late payment clauses

- send automated reminders

- track outstanding balances

We almost feel a bit silly recommending this since we can’t imagine a business today not suing invoicing software, but just in case, make sure you’re using one!

There are so many that offer free tiers that there’s just no reason not to use one.

2. Customise and automate reminders

Make sure to actually customise your invoice terms to suit business requirements or at least check what the default terms are in case they are a mismatch.

Also, set fixed intervals for all reminders to go out if payment is not received.

3. Have a dedicated party for debtors

If a customer ignores the final automated reminder, it should be clear who takes over be it a dedicated internal team member or a trusted debt collection service provider.

This ensures unpaid invoices don’t go unattended or get passed around randomly to team members who have no idea how to approach it.

4. Ensure bad debts get written off

Once all reasonable recovery efforts have been made, make sure to record the amount as a bad debt in your accounts and get a tax deduction.

That’s all from us, and we wish you all the best dealing with your customers!

Get in touch for a free debt recovery assessment

Rule & Co is a Malaysian debt recovery law firm with close to a decade of helping creditors recover debts via legal strategies that minimise upfront cost, maximise recovery, and safeguard their reputation. If your reminders have been ignored or you simply don’t want the hassle of chasing payments, get in touch.

💡 FAQs on recovering debts from customers in Malaysia

-

Q: What laws govern customer debt recovery in Malaysia?

A: The main considerations are the limitation period and interest rate on overdue invoices. Under the Akta Had Masa 1953, creditors have six years to recover debts, which resets upon payment or acknowledgment. Interest must be mutually agreed and reasonable—typically around 1.5% per month. -

Q: How can a business determine if a customer debt is worth pursuing?

A: Businesses should confirm that the debtor is still operating, that the debt is not disputed, and that the debtor has means to pay. Verification can be done through CTOS, SSM, or e-Insolvensi. -

Q: What are the main steps in recovering customer debts?

A: The process usually involves sending reminders, issuing a formal Letter of Demand, negotiating repayment, and taking legal action if necessary. The appropriate court depends on the debt amount. -

Q: What mistakes commonly reduce recovery success?

A: Recovery often fails when businesses delay escalation, allow indefinite extensions, or rely on verbal promises. Timely, documented action is essential for effective results. -

Q: How does court enforcement work for customer debts?

A: Once judgment is obtained, creditors may enforce payment by seizing assets, recovering through third parties, or initiating bankruptcy or winding-up proceedings for insolvent debtors. -

Q: Should a business use a debt collection agency or a lawyer?

A: Agencies are unregulated and operate on success fees, while lawyers are licensed by the Malaysian Bar Council and can issue Letters of Demand and commence legal action. Legal representation ensures compliance and professionalism. -

Q: Can a business claim tax deductions for bad debts?

A: Yes. Unrecoverable debts may be written off for tax purposes with proof such as a Letter of Demand and verification from a lawyer or auditor confirming non-recovery. -

Q: How does Rule & Co assist with customer debt recovery?

A: Rule & Co provides structured legal recovery services that minimise upfront costs, protect business reputation, and maximise successful debt recovery.